Why set the lower tax limit at $250K for individuals?

According to federal government data, 28.5 million Canadians are not expected to have any capital gains income at all. Three million are expected to earn capital gains below the $250,000 annual threshold.

The data also indicates only 0.13 per cent of Canadians — people with an average income of about $1.4 million a year — are expected to pay more in personal income tax on their capital gains as a result of the change.

Source: https://www.cbc.ca/news/politics/capital-gains-tax-budget-1.7176370

Capital Gains Update News

Your questions answered about the proposed capital gains tax changes

How are capital gains taxed and what's changing?

Right now, only 50 per cent of capital gains are taxable. That person who sold a cottage for $100,000 more than they paid for it is taxed only on $50,000 of the profit.

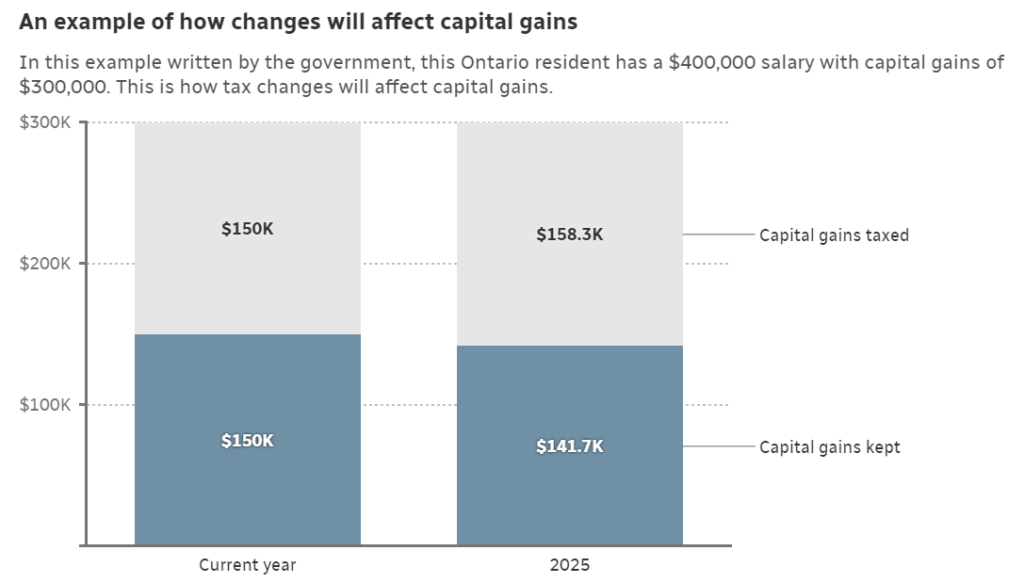

The 2024 budget would increase the “inclusion rate” from one-half to two-thirds on capital gains above $250,000 for individuals.

So for the first $250,000 in capital gains, an individual taxpayer would continue to pay tax on 50 per cent of the gain. For every dollar beyond $250,000, two-thirds would be taxable.

The budget proposes to tax all capital gains earned by corporations and trusts at the two-thirds rate.

If adopted, the tax changes would take effect on June 25.